Sample System Size

9.5K System for a Conservatively Produces 14ooo kilowatts Per Year

Cost Per kilowatt from The Power Company

21.6 cents Per Kilowatt Including Fees and Taxes based on sample bill below. This means a 9.5K Solar System will produce roughly enough energy for a $216 a month power bill, which is based on extremely conservative estimate of production.

Cost Per Kilowatt for Solar

2.60 Per Kilowatt for a total cost of $24,700

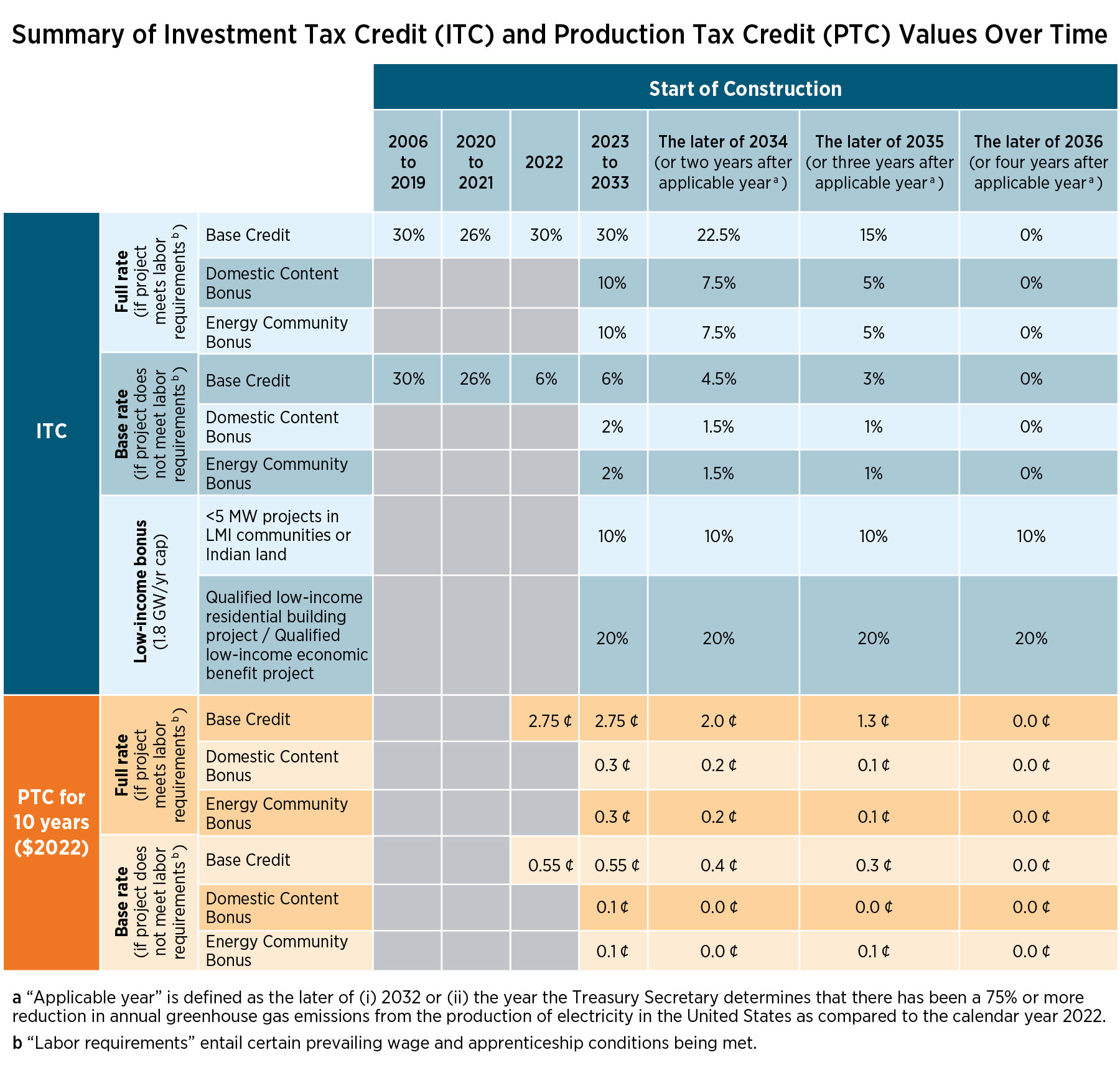

Deduct 30% Tax Credit* of $7410*

$1.82 Per Kilowatt for a total Net Cost of $17,290

The Power Company Charges $216 per month totaling $2592 a Year.

Based on $2592 a year a home solar system will offset the original cost of $17,290 in a little under 7 years, at which point you will be banking a minimum of $216 a month for the remainder of the life of panels designed to last 25 years or more.

Total Solar Savings for 20 Years

Over a 20 Year period you will have paid a minimum of $51,840 to the power company based on a $ 216-a-month power bill. You will have paid $17290* for the same power. This equation does not consider power company price increases over the next 20 years. Based on paying $51,840 to the power company over a 20 year span the total cost of a home solar system without utilizing the tax credit a home solar system is still a great value.